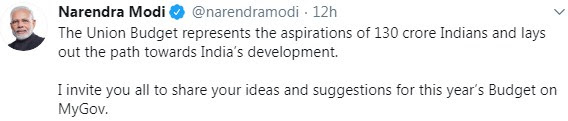

To make Union budget of 2020 more prominent, reasonable and meet the demands of people, recently India’s Prime minister Narendra Modi has tweeted to seek the views and opinions of Indian citizens for this year’s budget. After the tweet, some Technology industry veterans and businessmen come forward with their views and apprehensions including some suggestions to make this Union budget more valuable and country friendly. Here are some of their views, go through to know what exactly they think.

.@FinMinIndia looks forward to your suggestions for the #UnionBudget2020 which will be presented in the Parliament in the upcoming session.Share your valuable ideas in the field of #Farmers, #Education & others. https://t.co/2uCMdyuZRK @nsitharaman @nsitharamanoffc @ianuragthakur pic.twitter.com/VZiPYeTgZz

— MyGovIndia (@mygovindia) January 5, 2020

Shibu Paul, VP – International Sales at Array Networks

“With more and more security breaches happening every day, we expect the government to have a greater focus on creating more funds to battle the growing concern of cybersecurity in India. The government needs to focus on creating strong domestic manufacturing policy favouring global companies to invest more in India. We would require the government to create policy frameworks that incentivize investments from big players in manufacturing locally in India.

As far as Data security is concerned, our government needs to work on policies and reforms to increase qualified cybersecurity professionals, waive off taxation for homegrown cybersecurity technologies as well as set up local compliance for Data Security across all sectors. Smart city initiative with a strong push towards rural e-infrastructure with an added emphasis on security compliance and data protection would be beneficial for creating a positive impact on organizations. The government should provide a strong thrust for core R&D investments as part of its ‘Make in India’ initiative, enabling more indigenous innovation and increased investments in future technologies to shape the IT infrastructure and increase adoption of technology to encourage digitization.”

Ritesh Keshavrao Deokar, Country Manager at Milestone Systems India

The India Government’s “Digital India” initiative has kicked-off well as expected. Adoption of technologies such as Cloud, IoT, Blockchain, Machine Learning etc., has seen significant benefits across both the private and government sectors and especially so in areas of Retail, Transportation and Smart cities. With the government’s Smart Cities initiative, we foresee that every individual will be influenced digitally in some way or another and will need to be prepared for a digital transformation.

While cybersecurity remains at the epicentre of all digital deployments, we at Milestone Systems, strongly believe that personal security, as well as personal data protection, is of equal importance and technology companies have to take responsibility for the data that we have. Our expectation from the union budget is that the Government should emphasize more on the personal security of individual citizens and their data. We hope that more budget can be allocated in the form of subsidies and tax exemptions to the companies, and or manufacturers dealing with security products.

Sriram S, Co-Founder at iValue InfoSolutions

We expect new policies and frameworks promoting homegrown IT innovations to be a vital part of budget. There is a need for continued reforms for inclusive growth in areas of home, education, health and employment. As most banks spend most of the time nowadays managing NPA issues, we expect the Prime Minister and the Finance Minister to restart bank lending on priority.

IT will continue to drive success for all types of business with innovations and this, in turn, will determine the overall success of other industries including the government’s digital drive. Hence IT industry, as the enabler for the success of all other government and private business, should be accorded special status. The startup, SME, and SMB need to be efficiently addressed so that they grow and provide employment in a sustained way.

Government and RBI need to cut interest rate and ensure credit at affordable rates for business to build on the growth momentum. Also, we expect the Finance Minister to expedite TDS refunds which are stuck for 3 to 5 years helping business with cash flow in the absence of bank funding. As a system TDS refunds should be closed within 2 years with all data now available online in real-time. The government should consider the extension of Tax sops for companies which are increasing employment, till economy revives.

Arvind Didwania, Founder at ANT MY ERP

“We believe that allowing SOPS for MSME sector that involves less and easy steps to access credit will surely boost the Indian MSME sector. We expect the budget to highlight startup-friendly policies and tax reformations to boost the economy. We need more policies favouring local businesses. The government should focus more on implementing a refined education policy with an added focus on skill development for crucial next-generation technologies such as AI, big data analytics and robotics.

The budget should focus more on kick-starting domestic and foreign investment to make India a more desirable FDI destination for future investments. We need proper policy and framework from a holistic perspective covering tax reforms and skill development to better meet the skill gap. For this to happen we need more policies that make our education system further liberalized as well as globalized to accommodate new imitative towards vocational training, thereby addressing crucial employability issues. Education loans should be made easily available to all at lower interest rates.”

While the overall intention is in the right direction, the government through this union budget should take new measures to constructively boost the economy.”

Satish Kumar V, CEO at EverestIMS

“Amidst the economic slowdown in 2019, the Union Budget 2020 should revive the specific growth elements which will boost the economy. FM needs to focus on offering special budgetary concessions to manufacturing, IT, transport, and farming industries.

We suggest our government for an extension and relaxation in GST payment cycles for start-ups. The time period of tax rebate approvals for start-ups should be minimized.

The government should allocate more funds for programs which help Indian start-ups grow bigger and gain presence in international markets too.”

Tarun Bhutani, Managing Director at AMANI

IT Industry leaders are excited about the Union Budget 2020. We are expecting that the upcoming budget will have measures to spur the ‘Make in India’, ‘Digital India’ and ‘Smart Cities’ initiatives. The industries have flourished a lot, but there has been a full stop for grey channel market or grey imports. With initiatives like ‘Digital India’ ‘Make In India’, the government is committed to the growth of the manufacturing sector. This evolving aspect of the IT industry brings in immense business opportunities but requires special attention for its optimal utilization. So the government should roll out new schemes and incentives to encourage the electronics manufacturers to take these initiatives to the next level.

In September 2019, the current government took a bold decision of lowering Goods and Services Tax (GST) rates on items like outdoor catering, hotel accommodation, diamond job work, electric vehicle, and housing, but still the government is continuously facing tough questions over the current economic situation of the country. We expect the budget to address the dip in GDP growth rates and take constructive steps to boost India’s economy. We hope that 2020 will be a better year for the markets as compared to 2019.

Rajendra Chitale, CFO at Crayon Software Experts India

“Last year’s budget took serious considerations for jurisdiction-free and faceless assessment and scrutiny to simplify compliance, reduce manual work and speed up the tax processing. The budget from an indirect tax perspective was mostly aligned to digital initiatives of the government and promoting ease of business in India.

The recent slash in corporate tax was a major reform for the industry. However, for sustained growth in business, more people must buy products/solutions, so we are expecting reliefs in personal income tax rates this year.

Also, the cash flow strains of businesses can be lowered by pushing the TDS payment date (which is currently on the 7th of next month) to 27th of next month – move 20 days. This will give some breathing space to companies to recover money from their customers and make payment of TDS.

Related Posts

Interview with Ms. Bhavna V, Co-founder, Nysh.in

What technology will be used in flying cars? Having a look at the technologies that will shape the transportation of the future

The Climateur’s Creed: Shailendra Singh Rao and the Mission of Creduce

What is stopping smartphone gaming from becoming the next big thing? The problems, and the possible solutions

What are the 5 Types of Green Technology?

How Enterprise Technology is Revolutionizing Business Operations in 2024