Technology has revolutionized the entire banking sector, and it is only expected to grow further. But still, a majority of our population is alien to this innovative development. A lot of people still go out to physical shops in order to recharge their mobile numbers, while they can do the same from the comforts of their home. So, if you also wish to recharge your mobile number on your own, then just stay tuned till the end of this very simple article.

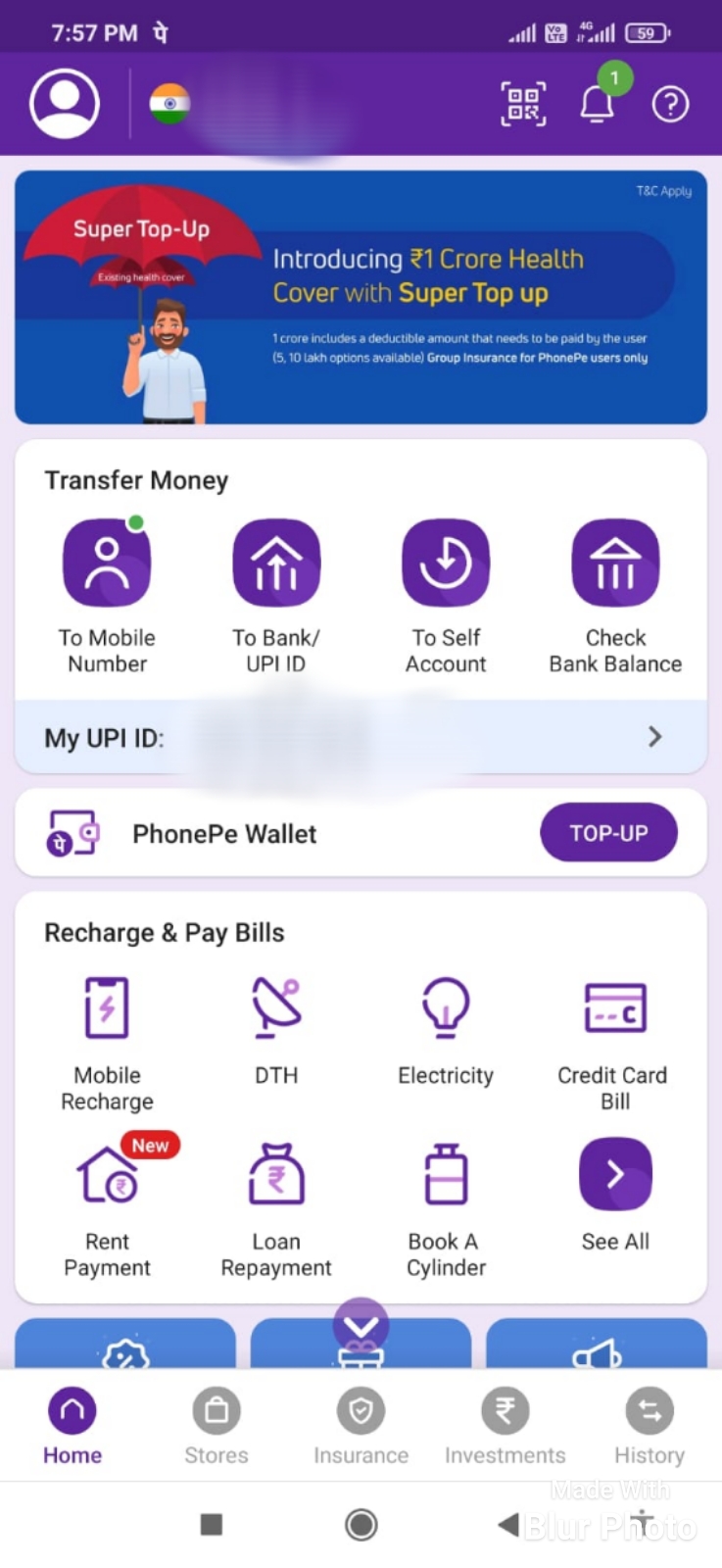

Step 1: Launch your digital banking platform in which you have a registered UPI id.

Note – we shall be accomplishing this task using the UPI method because it is quite simple, but you can also use various other methods like – debit card, credit card, NEFT, imps, and much more.

Step 2: Once your app/portal launches, just browse and locate the ‘Mobile recharge’ option and click on it.

Note – I have used the PhonePe platform, you can use any platform in which you are having your registered UPI id.

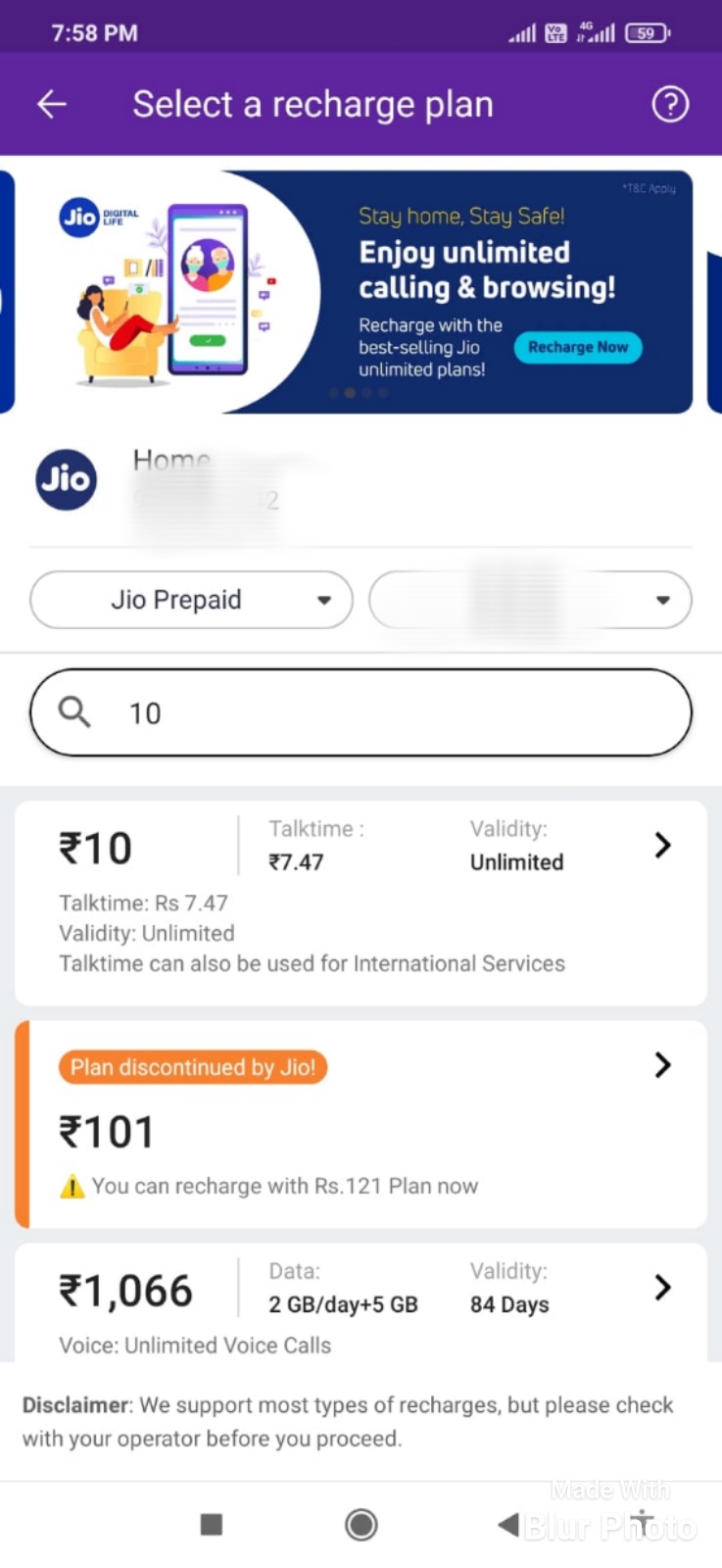

Step 3: Now, enter the relevant details, like – the mobile number which you want to recharge, the amount of recharge (you can also browse through various recharge amounts), and then the location of your sim card.

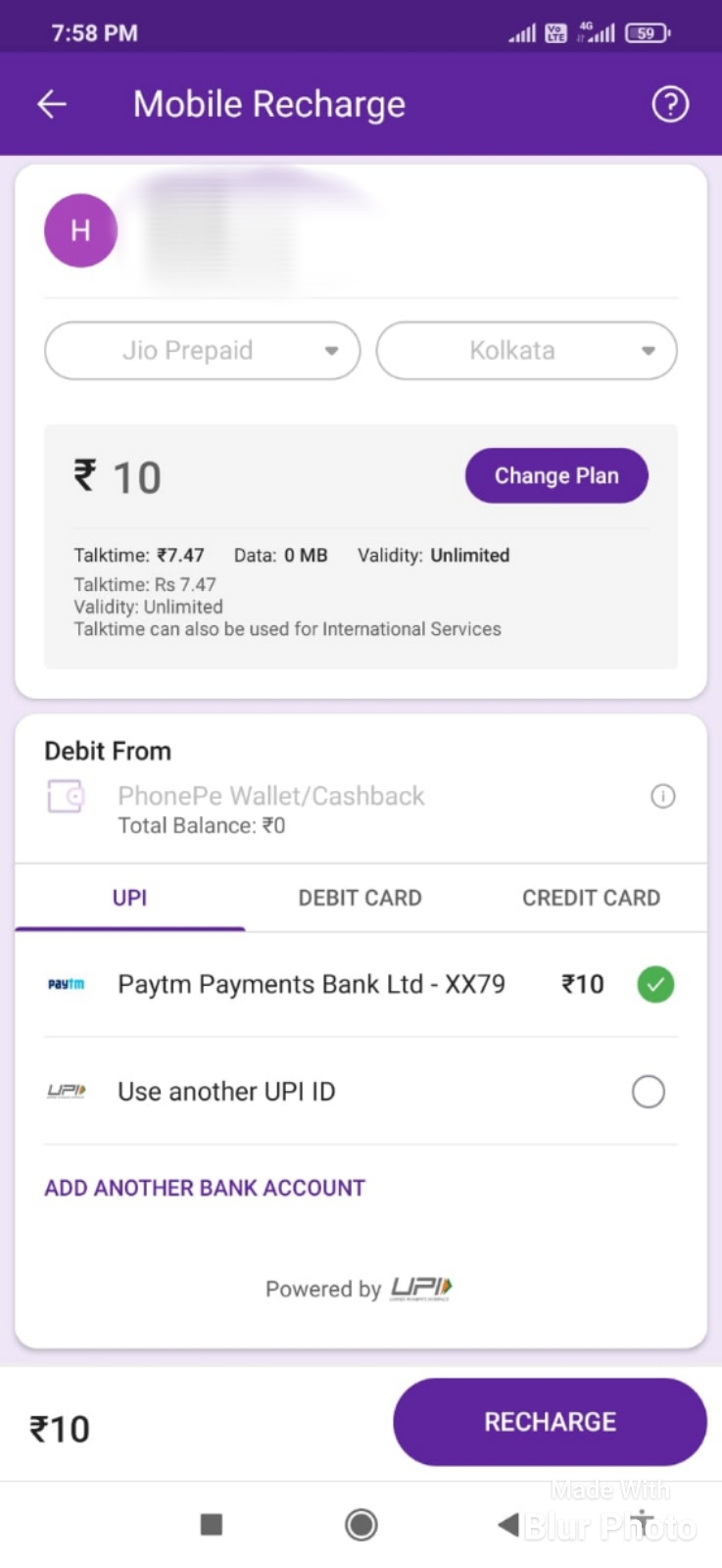

Step 4: Once you are done with all these, simply click on the UPI option available below under the payment options.

Step 5: It will showcase you your UPI id and your bank account registered with this digital banking platform, just validate them and then proceed further.

Step 6: Enter your secret UPI pin for online transactions and then proceed further.

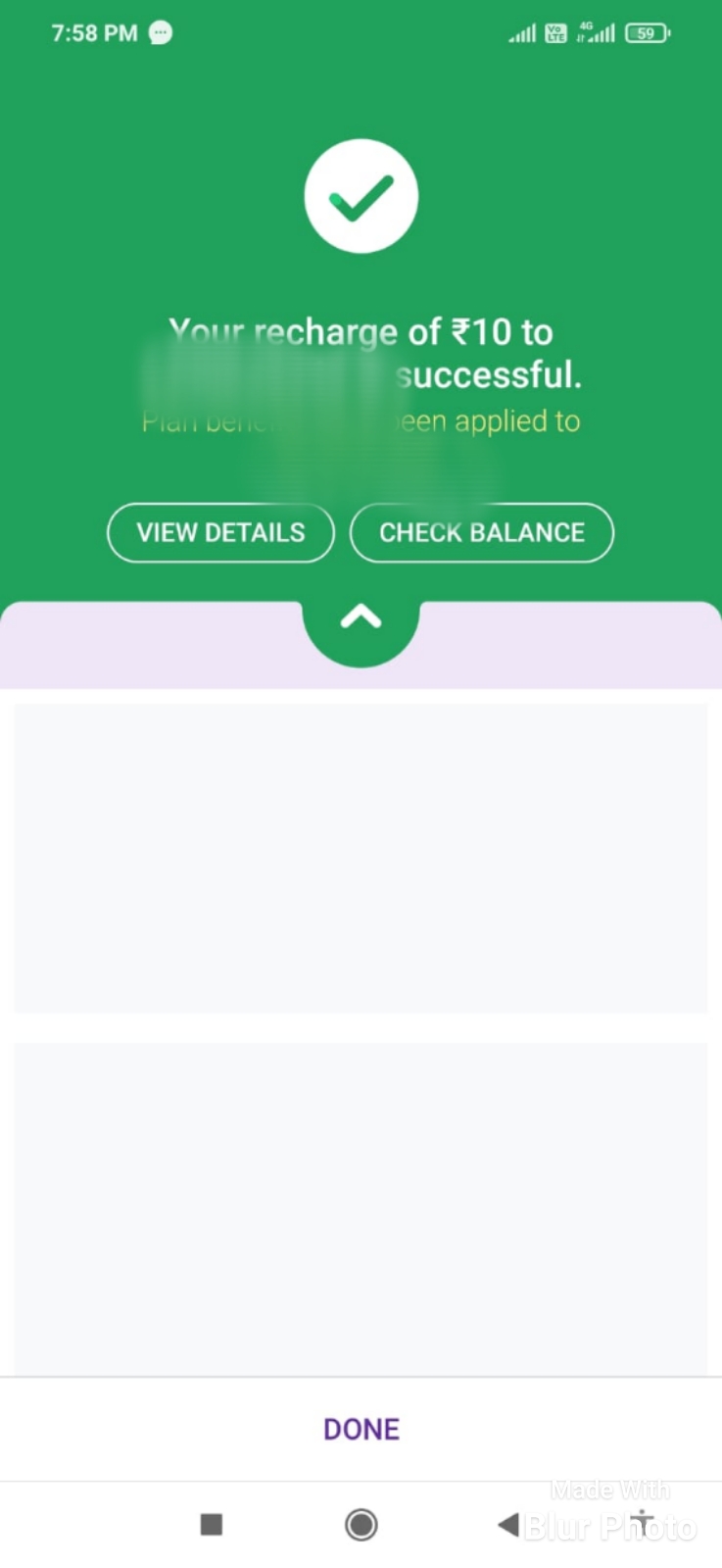

Step 7: Therefore, your mobile recharge is successful.

FAQs

What is meant by online mobile recharge?

In simple words, it means that you can recharge your mobile number right from your home or office with ease using digital banking services.

Why is the UPI method considered the best method for major online payments?

If your online payment deals with less amount of money, then UPI id is the best method because you only need to enter the registered UPI id of the receiver and then make the transaction and its only limitation is that it is limited to small payments.

How will I be able to know if my recharge is successful or not?

You will get a successful payment receipt from your digital banking platform and also a confirmation SMS on the mobile number that you recharged.

What if my amount was deducted but recharge was not successful?

In that case, you will get your refund within 48 working hours and you can also raise your concern by placing a request or the same using your UPI reference id that you will get once you make your transaction.

Under what circumstances can my transaction fail?

Your transaction can be failed in the following cases:

- If there is a mismatch in your KYC credentials.

- If you do not have sufficient funds in your bank account.

- If there is some technical or server problem.

Is this method chargeable? Will I be charged any fees, penalty and is there any hidden charge?

No, this method is completely free.

Is this method safe?

Yes, it is a safe and secure method.

Related Posts

How to create email groups in Gmail? Send one email to multiple recipients in a matter of seconds.

Getting the right dashcam for your needs. All that you need to know

How to Install 7-Zip on Windows 11 or 10 with Single Command

How to Install ASK CLI on Windows 11 or 10

How do you install FlutterFire CLI on Windows 11 or 10?

How to create QR codes on Google Sheets for URLs or any other text elements