As we enter the post-COVID-era, the challenges continue to wreak havoc on growth in the banking sector with low-interest rates and revenue gaps. These challenges have made cost reductions necessary for survival and gaining a competitive edge.

An industry analysis shows that 80% of banks will implement a cost-reduction strategy in the next two years, Spend Analytics and optimization is excellent place to start!

With procurement accounting for almost 30 to 40 percent of the banks’ operating costs, optimizing your spending in this area is essential.

Here’s why spend optimization is important and how your bank can minimize unnecessary spendings by transforming and digitizing its procurement process:

1. Centralization

When data is manual and decentralized, it is prone to errors and inconsistencies, which costs banks money and time. It also makes it difficult to see where the money can be saved, limiting banks from making the right decisions. This increases the chances of maverick spending.

With the help of automation, you can centralize all your procurement processes, giving the managers clear visibility on where the money is being spent—this aids in saving unnecessary expenditures and helps allocate the money where it is critical to spend.

2. Review existing contracts

Reviewing contracts can help banks in spending reductions by keeping up with the present regulations set up by government institutions that might have an effect on the procurement cycle.

With automated processes, banks can review hundreds of contracts in their portfolio. In addition, the automation software can help highlight the terms and conditions you are interested in and verify them against the existing scenarios, saving you from deadline penalties and so on.

3. Eradication of Incompetent Suppliers

Banks need to verify that the contractual suppliers are keeping their part of the agreement and complying. If there are any inconsistencies, flag them right away, address them and, if necessary, look for other suppliers who can match your needs.

For example, you can reveal suppliers in your database who aren’t performing well with an automated benchmarking process. Then, these suppliers can be approached to discuss their limitations as highlighted by the software. If there are major shortcomings from the supplier’s side and can not be resolved easily then you can eliminate and offboard such suppliers by shifting spending to more competitive suppliers to gain more value for money.

4. Supplier Consolidation

Maximizing procurement savings requires active supplier management and consolidation of the overall number of them. With fewer suppliers to handle, the process becomes more efficient.

With the help of spend management software, banks can see who their preferred suppliers are, their pricing, and their offerings. Besides that, it can vet them based on the bank’s conditions and preferences.

Suppliers available in a consolidated form also end fragmented spending by providing greater visibility. Apart from that, as there are fewer suppliers, banks may direct a higher volume of orders to specific suppliers, resulting in more significant savings in the form of discounts.

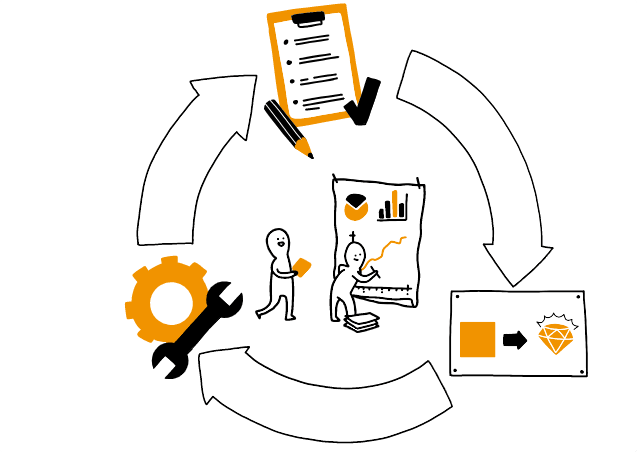

5. Digital Transformation

Digital transformation may seem like an expensive affair in the beginning. However, the competency of a procurement system guarantees that the desired results counter the initial costs.

Eliminating paper-based procurement can help in cost optimization by reducing the chances of errors, increasing visibility, enhancing collaboration, and allocating resources effectively with the help of automation.

Moreover, generating, processing, and delivering documents digitally eliminates the demand for conventional manual resources – such as printers, photocopiers, fax machines, and servers – thus reducing the additional costs.

Impact of Digital Procurement

Digital procurement has changed the way businesses transactions take place. It has automated the purchasing procedure and has furnished excellent results for both the banks and the suppliers.

With the help of one-stop-shop spend management software, the banking sector can achieve significant ROI because of increased productivity, and enhanced agility, along with helping them maintain liquidity and profitability.

About the Author:

Mohammed Kafil is a certified procurement consultant who has been coaching companies to establish resilient  digital procurement operating models for over a decade now, working as Sr. Product Manager at Kissflow Procurement Cloud. With Kissflow Procurement Cloud, a flexible procurement software that streamlines the end-to-end procure-to-pay process, and also eventually the vendor management process. Kafil helps medium and large enterprises with their digital transformation projects. In the recent past, he has also worked with Fortune 500 companies to implement platforms like Coupa, Ariba, Ivalua, and BuyerQuest.

digital procurement operating models for over a decade now, working as Sr. Product Manager at Kissflow Procurement Cloud. With Kissflow Procurement Cloud, a flexible procurement software that streamlines the end-to-end procure-to-pay process, and also eventually the vendor management process. Kafil helps medium and large enterprises with their digital transformation projects. In the recent past, he has also worked with Fortune 500 companies to implement platforms like Coupa, Ariba, Ivalua, and BuyerQuest.

Related Posts

Connect & Manage AWS lightsail Windows server using WAC

Ethical Considerations in Digital Banking: Privacy, Data Ethics, and Responsible AI

Top 8 technology buzzwords that you should know in 2023

What is Open source IoT stack?

Top 10 Free Open Source Blogging Platforms or CMS in 2023

6 Best Open source Personal Cloud Software to Setup Cloud storage