At present, online payments are an essential part of people’s life. Millions of folks are doing online money transaction with the help of verity of cards. It makes our lifestyle easier but one thing is also true that sometimes this user-friendly concept could become risky. We all heard about online fraud and online hacking. There are many methods of online transaction available but in this particular article, we will discuss the two of them, one is PayPal and other is Credit Card. To know which is better PayPal or Credit cards?

Now, the obvious thought we can have regarding this would be the question of safety about both services.

First, we will start with PayPal vs Credit Card.

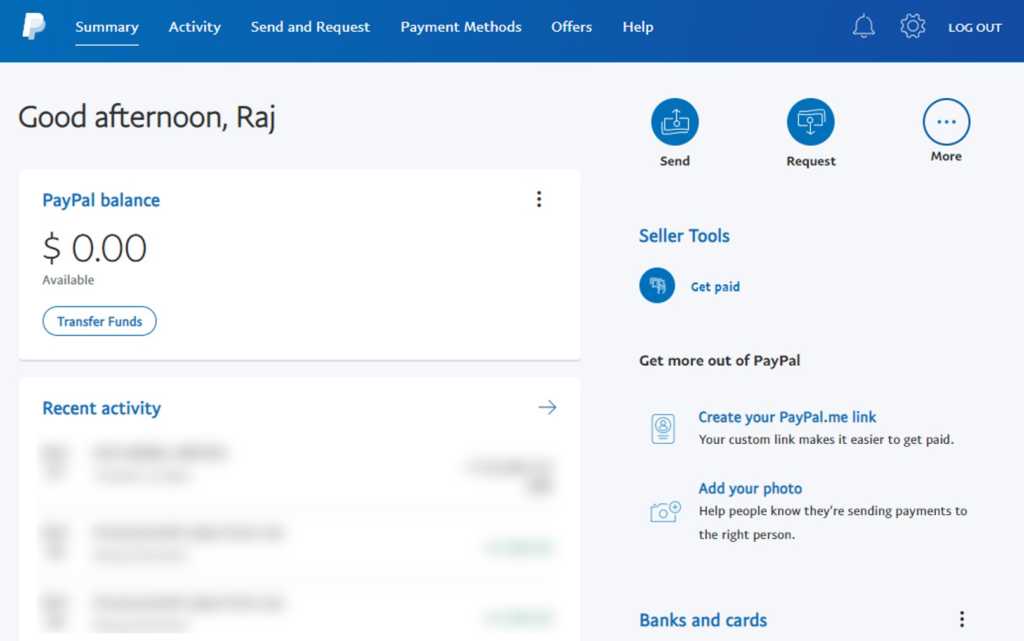

Description and overview of PayPal

The most important thing during the process of international trade or international shopping and consumption is a payment problem. As we know different countries of the world have their own currency in circulation and as per the growth and purchasing power, there are certain exchange rules between different currencies. Hence, this issue arises troubles for international trade payment or international shopping consumption behaviour.

Keeping this in mind, Elon Musk, the original founder of PayPal, put forward the original international online payment concept and put it into practice, which made PayPal initially gain a batch of users. Later, this system got a boost and proved helpful in international trade development. And Paypal quickly became a national online payment tool favoured by people around the world.

Now, PayPal is a worldwide online payment system; it supports online money transaction like money sending or receiving and also holding of funds. PayPal is an American Company, it supports 25 types of currencies worldwide, and has 286 million of users, the users can receive or send money in any online purchase, donations, using this account they can shop or sell throughout the world. According to the company, PayPal is the safest option for online payments, the method of using PayPal is also very simple and hassle-free. The steps are very straightforward and anyone can easily open their PayPal account and use it anywhere globally for money transaction.

Pros and Cons of using PayPal?

Pros:

- With the help of PayPal, you can send or transfer money to anyone globally, and if you think the process will be so long then you are absolutely wrong, this is an easier way to transfer money at any time anywhere in the world.

- You can get free services and that is the best part about PayPal, you don’t have to pay any type of monthly or yearly fees for opening account.

- This is the fastest option to transfer money. You do not have to wait longer to transfer money.

- PayPal also accepts payments through credit cards or debit cards, if any of your friend or a person wants to send money to you then the requirement of PayPal account for them is not necessary.

Cons:

- If any customer faces any kind of money transaction problem then it is quite difficult to contact the customer service operator.

- PayPal will charge you for non-PayPal payments.

- Some PayPal rules are so strict and difficult to understand, and your account can get locked for any type of mistakes.

Credit card

We are familiar with this name ‘CREDIT CARD’. There are different types of banks and different types of credit cards. The rules of using these cards slightly different one to another, sometimes we get calls for buying credit cards or whenever we go to the bank, we are advised to take a credit card. Or some people take these chip-based cards by their own choices and use it.

Definition of Credit Card

In simple words, a Credit card is a card which allows you to borrow money from the bank to buy something. The card is given by a bank, and the customer has to pay back the money within the time period. Every card has a certain amount of maximum credit limit and the consumer have to pay the interests on the amount they borrow from it along with the charges of the card.

Pros and cons of a credit card.

Pros:

- You don’t need to carry cash all the time.

- In case if you don’t have sufficient money or bank balance to buy a product then you can have it by using the credit card.

- You can get a high discount on online shopping by using credit cards.

Cons:

- You have to pay the interest on credit card and the monthly charges will be an addition to it.

- The security of any Credit Card is a questionable thing because of the news we hear frequently about on card cloning.

- Bank will charge an extra fee for the late payments.

- You can buy things and pay later but the card will have a maximum limit and we cannot cross the limit given by the bank.

- Somewhat high charges on funds transactions internationally as compared to Paypal.

Which one is the better option and why?

According to me and the reports, we get from the internet or newspapers other researches, I can consider PayPal is a more safe and better option than a credit card.

Why PayPal is better than credit cards:

- PayPal is a more safe, secure and easier option for payments.

- Using PayPal, you can send money or receive money from anywhere in the world but on the other side with credit cards, you will not have that option.

- You don’t have to pay any type of charges for your PayPal account but you have to pay the credit card charges.

- You can also get credit card option in PayPal and for that, you don’t have to pay a high-interest rate.

Final statement

Depending on the above discussion it is safe to pick PayPal over any other Credit Card we can get from the market. PayPal offers more safety and reliability that a customer should seek for any money-related services.

Other Articles:

- Top 10 tips to be safe with online and mobile banking

- Best Ways to save and earn an extra bit of money

- How to check EPF balance check using the mobile number in India

- What are Microtransactions in games?

very nice article. thank you